Fixed Income: Key rate shift technique (FRM T4-43)

21:26

Value (VaR) Mapping a fixed-income portfolio (FRM T5-05)

27:20

Convexity and risk premium impacts on shape of term structure (FRM T5-08)

15:21

Why par yields are the best interest rate measure

19:46

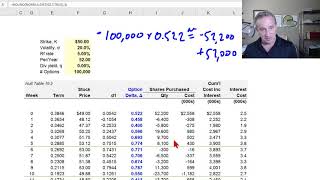

Dynamic option delta hedge (FRM T4-14)

21:49

Lognormal property of stock prices assumed by Black-Scholes (FRM T4-10)

19:37

Historical simulation (HS VaR): Basic and age-weighted (FRM T4-2)

21:56

Risk-neutral probabilities (FRM T5-07)

46:03