Valuation of Contingent Claims: Part II – BSM Model & Greeks (2024 Level II CFA® Exam –Module 2)

1:04:04

Real Estate Investments (2025 Level II CFA® Exam – Alternative Investments – Module 1, 2 & 3)

50:14

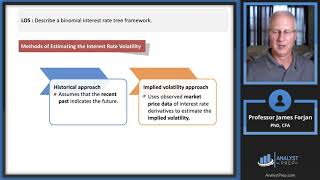

The Arbitrage-Free Valuation Framework (2024 Level II CFA® Exam – Fixed Income –Module 2)

1:10:28

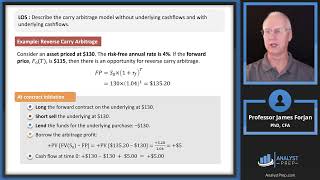

Pricing and Valuation of Forward Commitments (2024 Level II CFA® Exam –Derivatives–Module 1)

1:10:05

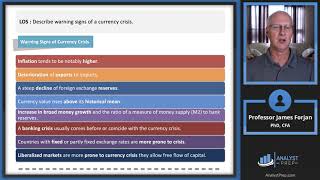

Currency Exchange Rates: Understanding Equilibrium Value (2024 Level II CFA® Exam–Economics–Module1)

45:37

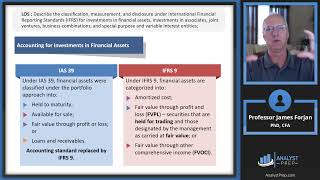

Intercorporate Investments (2024 Level II CFA® Exam –FRA–Module 1)

49:18

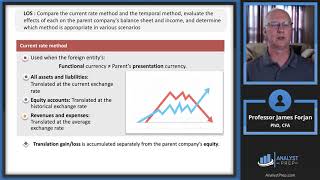

Multinational Operations (2021 Level II CFA® Exam – Reading 15)

1:09:07

Analysis of Dividends and Share Repurchases (2024 Level II CFA® Exam –Corporate Issuers–Module 1)

26:21