Implied Volatility, Volatility Skew, and the Term Structure of Volatility

16:43

Zero cost long position on the SPY

15:29

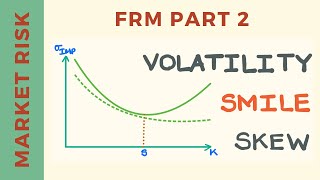

Volatility Smile and Skew | FRM Part 2 | Market Risk

40:07

How to Calculate Realized & Implied Volatility and Why it's Important - Christopher Quill

23:35

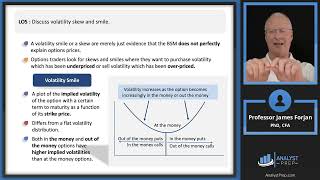

Options Strategies – Part III: Volatility Skew and Smile, and Strategies (2025 Level III CFA® – R7)

23:45

A Smarter Long Call Options Strategy | How to Buy Calls on thinkorswim®

24:27

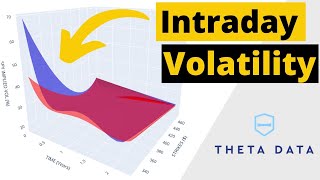

Can You Compare Intraday Volatility Surfaces?

55:24

My approach to Portfolio Management for the Retail Investor

14:14