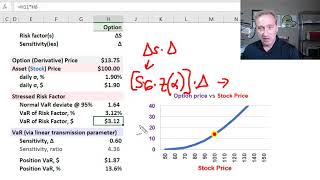

Delta-gamma value at risk (VaR) with the Taylor Series Approximation (FRM T4-4)

18:56

Coherent risk measures and why VaR is not coherent (FRM T4-5)

24:07

Delta-normal value at risk (VaR, FRM T4-3)

30:28

Fixed Income: Key rate shift technique (FRM T4-43)

12:36

Dear Calculus 2 Students, This is why you're learning Taylor Series

19:46

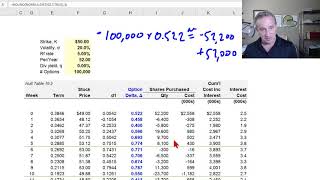

Dynamic option delta hedge (FRM T4-14)

22:20

Taylor series | Chapter 11, Essence of calculus

1:21:15

7. Value At Risk (VAR) Models

18:10