Overview of Credit Portfolio Models

10:12

Managing Market Risk

16:18

Quantitative Credit Risk Models

14:35

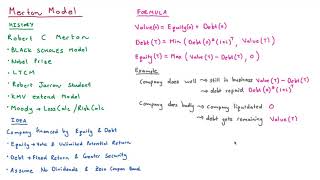

Merton Model for Credit Risk Assessment

12:06

Credit Modelling Challenges

29:24

AP Statistics Lecture 7.3: Sample Means

1:28:38

16. Portfolio Management

1:21:15

7. Value At Risk (VAR) Models

21:33