Three approaches to value at risk (VaR) and volatility (FRM T4-1)

19:37

Historical simulation (HS VaR): Basic and age-weighted (FRM T4-2)

1:21:15

7. Value At Risk (VAR) Models

14:54

Trump Spins After Musk & Rubio Blowup, Pentagon's War on Woke & Jimmy vs Daylight Saving Time

16:48

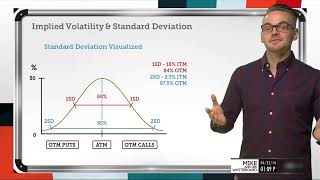

Implied Volatility & Standard Deviation Explained

28:55

Murphy: Six Weeks In, This White House Is On Its Way To Being The Most Corrupt In U.S. History

22:29

Value at Risk (VaR) Backtest (FRM T5-04)

20:39

Calculating and Applying VaR (FRM Part 1 2025 – Book 4 – Valuation and Risk Models – Chapter 2)

28:06