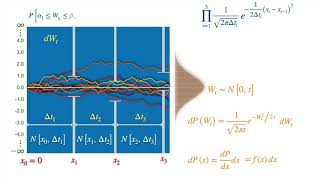

Stochastic Calculus for Quants | Risk-Neutral Pricing for Derivatives | Option Pricing Explained

21:35

Trading stock volatility with the Ornstein-Uhlenbeck process

49:03

Binomial Option Pricing Model || Theory & Implementation in Python

31:22

The Trillion Dollar Equation

26:34

Simplified: Girsanov Theorem for Brownian Motion (Change of Probability Measure)

22:20

Stochastic Calculus for Quants | Understanding Geometric Brownian Motion using Itô Calculus

49:52

19. Black-Scholes Formula, Risk-neutral Valuation

1:29:38

Energy Trader, Analyst, and YouTuber Jonathon Emerick

27:25