Options Strategies – Part III: Volatility Skew and Smile, and Strategies (2025 Level III CFA® – R7)

43:46

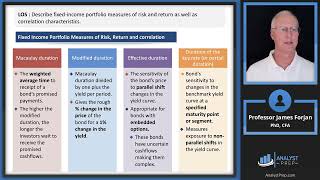

Overview of Fixed-Income Portfolio Management (2025 Level III CFA® Exam – Reading 10)

42:17

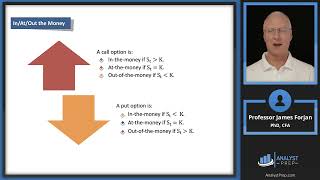

Options Strategies – Part II: Covered Call, Protective Put, and Spreads (2025 Level III CFA® – R7)

35:08

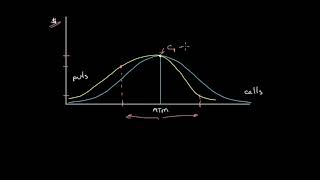

Implied Volatility, Volatility Skew, and the Term Structure of Volatility

21:25

Options Strategies – Part I: Asset Returns Replication (2025 Level III CFA® Exam – Reading 7)

1:25:06

Framework and Macro Considerations (2025 Level III CFA® Exam – Reading 1)

10:43

Volatility Skew Explained | Options Trading Concepts

56:31

Beyond Basics: Strategic Trading with Implied Volatility & Skew

25:13