CFA Level 2 | Derivatives: Valuing an American Call Option (Binomial Option Pricing Model)

7:19

CFA Level 2 | Fixed Income: Par Bond and Maturity Matched Rate and Negative Key Rate Durations

13:33

CFA Level 2 | Derivatives: Valuing Interest Rate Options Using Binomial Option Valuation Model

30:47

CFA Level 1 | Derivatives: Binomial Option Pricing Model

14:12

2017: CFA Level II: Derivatives - Valuation of Contingent Claims - Swaptions

9:23

Black Scholes Option Pricing Model Explained In Excel

6:21

CFA Level 2 | Derivatives: Valuing Forward Rate Agreement (FRA)

50:05

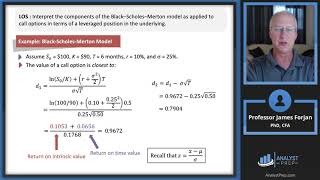

Valuation of Contingent Claims: Part II – BSM Model & Greeks (2024 Level II CFA® Exam –Module 2)

13:16