Value at Risk (VaR) - Advantages & Disadvantages Explained | FRM Part 1 / FRM Part 2 | CFA Level 2

17:00

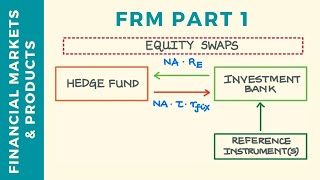

Equity Swaps Explained: Mechanics and Variations | FRM Part 1 | CFA Level 2

11:52

Expected Shortfall & Conditional Value at Risk (CVaR) Explained

14:22

Liquidity Coverage Ratio (LCR) Explained | FRM Part 2 | Liquidity Risk | CFA Level 2

11:04

CFA® Level II Fixed Income - Convertible Bonds: Features, valuation, and risk characteristics

1:21:15

7. Value At Risk (VAR) Models

14:53

Value at Risk (VaR) Explained!

45:45

FRTB Market Risk Capital Explained: What It Is and Why You Should Care

33:18