Comparing volatility approaches: MA versus EWMA versus GARCH (FRM T2-25)

12:12

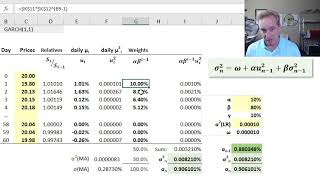

Maximum likelihood estimation of GARCH parameters (FRM T2-26)

14:45

Volatility: GARCH 1,1 (FRM T2-23)

21:49

Lognormal property of stock prices assumed by Black-Scholes (FRM T4-10)

19:44

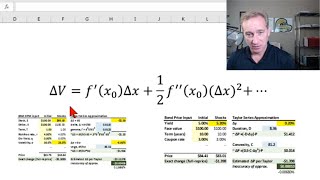

Delta-gamma value at risk (VaR) with the Taylor Series Approximation (FRM T4-4)

9:09

Exponentially Weighted Moving Average or Exponential Weighted Average | Deep Learning

27:20

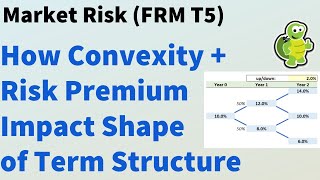

Convexity and risk premium impacts on shape of term structure (FRM T5-08)

11:37

Volatility: standard deviation (FRM T2-21)

21:11