CFA Level I Derivatives - Put-Call Parity

5:31

CFA Level I Derivatives - Binomial Model for Pricing Options

38:47

Option Replication Using Put-Call Parity (2024/2025 Level I CFA® Exam – Derivatives – Module 9)

8:42

CFA Level I Derivatives - Derivative Pricing and Replication

9:23

Put-Call Parity in Options Trading Explained Using Excel

8:24

CFA Level I Derivatives - Forward Contracts vs Futures Contracts

11:38

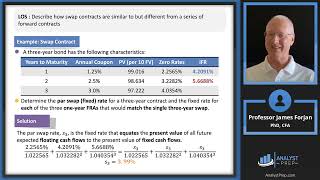

CFA® Level II Fixed Income - Understanding "Rolling Down the Yield Curve" Strategy

23:45

A Smarter Long Call Options Strategy | How to Buy Calls on thinkorswim®

28:51